Navigating a new website can take some getting used to, so we’re here to help and support our customers as they familiarise themselves with these changes. To give you an idea of what to expect, we’ve answered some key questions below – covering a range of areas from appearance and functions, to tackling fraud. We’ve also produced some handy videos to get you started.

What’s changed?

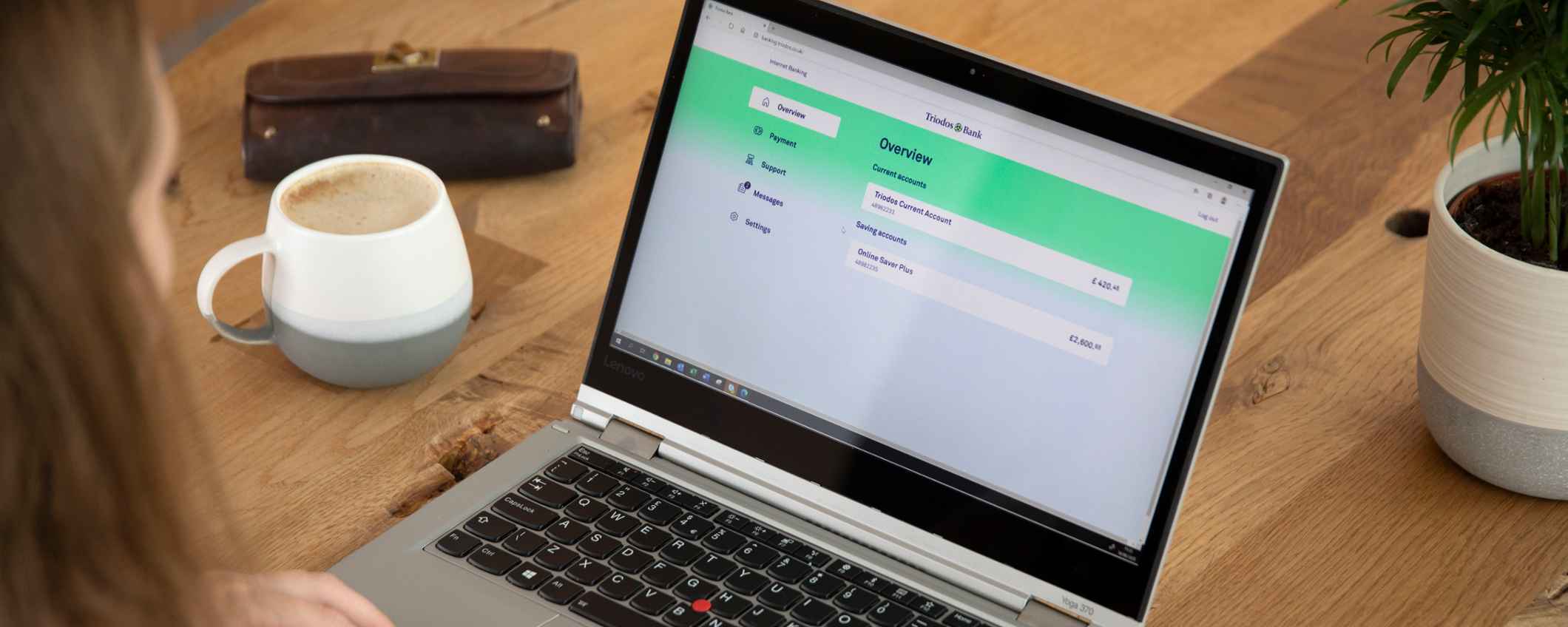

The new Internet Banking aims to be easier and simpler to use for your everyday banking needs. The first thing you’ll notice is that the design of the pages looks different – with the colours and layout now in the same style as our mobile banking app.

There have also been a number of functional improvements. It’s now easier to navigate to make payments, add new payees and set up regular payments.

Development is ongoing, so please note that you may be directed back to old Internet Banking for some services. A pop-up window on the site will always tell you when this is going to happen.

When will I see the changes?

The first phase of the new Internet Banking roll out will take place in March, starting with a small selection of customers. Customers will then gradually be upgraded to new Internet Banking according to the products that they have with us. No actions are required from you and you’ll be contacted by email to let you know when you will be upgraded.

How do I access the new Internet Banking?

After you’re upgraded, you won’t need to do anything differently. You can access Internet Banking the same way you normally do, from the top right-hand corner of our website. Log in the same way, using your username and password, or your digipass.

How do I navigate the new Internet Banking?

From the Overview page you can view all your accounts and select an account to view your balance and transactions. Other sections include:

- Payments – to make payments, add new payees and set up regular payments

- Feed – to view important notifications and messages

- Help – to access our help and support pages

- Self Service – to access and download statements and other important documents, as well as links to activate your debit card, start the Current Account Switch Service and update settings

Where can I learn more?

We’ve produced a series of short videos to give you an overview of the new Internet Banking. You can view the introduction video below:

This video is hosted by Youtube

By playing this video you allow Youtube to track your visit More info

The other videos cover frequently used processes, such as making a payment, setting up a payee or regular payment, activating your debit card and switching your current account. You can view them all on our YouTube playlist.

As ever, you can also refer to the Help & Support section of our website, where you can see the answers to many frequently asked questions.

Is the new Internet Banking safe?

The new Internet Banking has the same safety and security features of our previous Internet Banking.

Remember that Triodos will never send you a direct link to log into Internet Banking. Fraudsters will send links to fraudulent login screens and web pages, which may look very similar to the genuine site, in order to gain access to your account.

You can learn more about fraud awareness tips in the Help & Support section of our website, and if you are suspicious about any request please contact us.

More questions about Internet Banking?

You can refer to the Help & Support section of our website, where you can see the answers to many frequently asked questions, as well as videos to give you an overview of common processes. The section also features tips on how to protect yourself online.

Thanks for joining the conversation.

We've sent you an email - click on the link to publish your post.