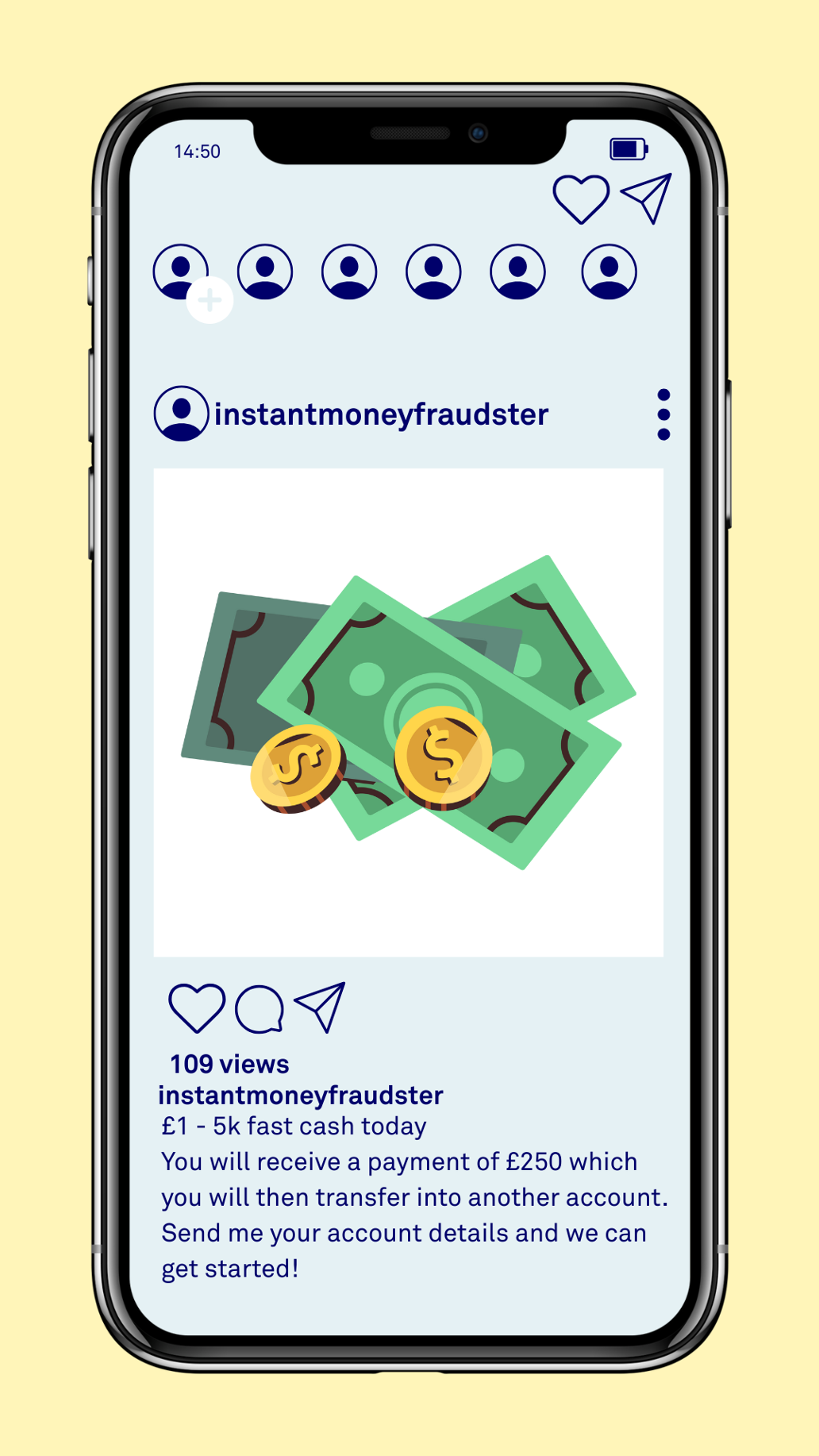

Criminals tend to target people who are likely to need money. Often, this can start with a post advertising 'easy', 'free', or 'fast' money, with an invitation to direct message to find out more. It can even be a seemingly genuine-looking job on social media platforms such as TikTok, Instagram, Snapchat and Facebook with the promise of making money quickly with little effort; reflective of a growing trend amongst people in their 20s being involved with money mule crimes.

What follows is the criminal asking you to receive money into your bank account and transfer it into another account, keeping some of the cash for yourself. Or they may ask you to hand over your bank account details and login information to them in order to receive payment.

The reality of this money moving aids criminals in hiding the origin of money gained illegally, or funds crimes such as modern slavery and drug trafficking. This process is referred to as 'money muling' and by participating, you become a money mule. Money muling is a type of money laundering, a criminal offence.

Cifas reports 16,061 cases indicative of money muling in the first half of 2025 alone. With serious consequences to this crime, it's important to stay aware of the risk of money muling, the scams that lure people in, and how to avoid being a victim.

How do money mule scams work?

Money muling can start in the same way as many other scams. These are intended to lure people in and provide an excuse to pass on stolen money. Often, the criminal will provide instructions to the victim which allow the laundering of illegal funds to take place, but the victim thinks they're doing something else like sending money to a friend or into an investment.

It can often start with:

- Employment scams - Criminals create fake job adverts, offering a quick and easy way to make money at home.

- Romance scams - Prospective money mules may be contacted via social media or dating websites by money launderers posing as romantic partners.

- Investment scams - Money mules are contacted online for an investment scheme or quick cash opportunity.

- Impersonation fraud - To get people's bank account details, criminals may pose as bank staff, the police, or even as individuals' acquaintances or relatives. Once they can access the victim's account, they can use it to launder money.

What are the consequences of becoming a money mule?

There are legal and financial consequences to becoming a money mule. It can lead to convictions of up to 14 years in prison, and your involvement in illegal activity will flag on a banking sector-wide database which can lead to:

- Closure of bank accounts

- Existing loans or credit facilities being made payable immediately

- Difficulty opening new accounts and applying for credit products, including mortgages.

Involvement in a money mule crime could lead to a criminal record, which can limit your employment opportunities in the future.

How do I protect myself from becoming a money mule?

- Do not accept any job offers that ask you to open or use bank accounts to move money

- Be wary of job offers where all interactions and transactions will be done online

- Be cautious of 'easy money' and 'too-good-to-be-true' offers

- Don't give your bank account details to anyone unless you know and trust them

- Never give anyone access to your bank account

If you are a parent of guardian of a young person, financial education about the risks of becoming a money mule raises awareness and discourages them from making the wrong choices. Find out more.

Thanks for joining the conversation.

We've sent you an email - click on the link to publish your post.