This update is part of a bigger commitment to improve your digital banking experience and evolve our technology to better suit you. As we roll out more Insights in the months ahead, our aim is to give you a better banking experience that aligns with your values and supports your financial goals.

What are Insights?

Insights can help you manage your money with personalised, timely updates tailored to your finances. You can see your transactions sorted into categories, such as Transport or Groceries, and you'll receive updates to let you know when something’s changed – such as an increase in a regular payment.

Having more information about your usual spending can help you to better understand your financial habits, so that you can spend more consciously and make sure your money is going towards the things that matter most to you.

What do we mean by conscious spending?

Conscious spending simply means being intentional with your finances. This involves aligning your spending and saving with your values and long-term goals.

By understanding your spending habits, you can make better financial choices that can improve your wellbeing, financial literacy, and help you build the kind of future you want.

Steps towards conscious spending:

Identify what really matters to you – this might be experiences, relationships, personal growth, or sustainability.

Create financial goals – set clear and realistic goals, both for the short and long term. This might be investing in your fitness, paying off debt, saving for a trip, or building an emergency fund. You can set specific savings goals in your Triodos Savings Account.

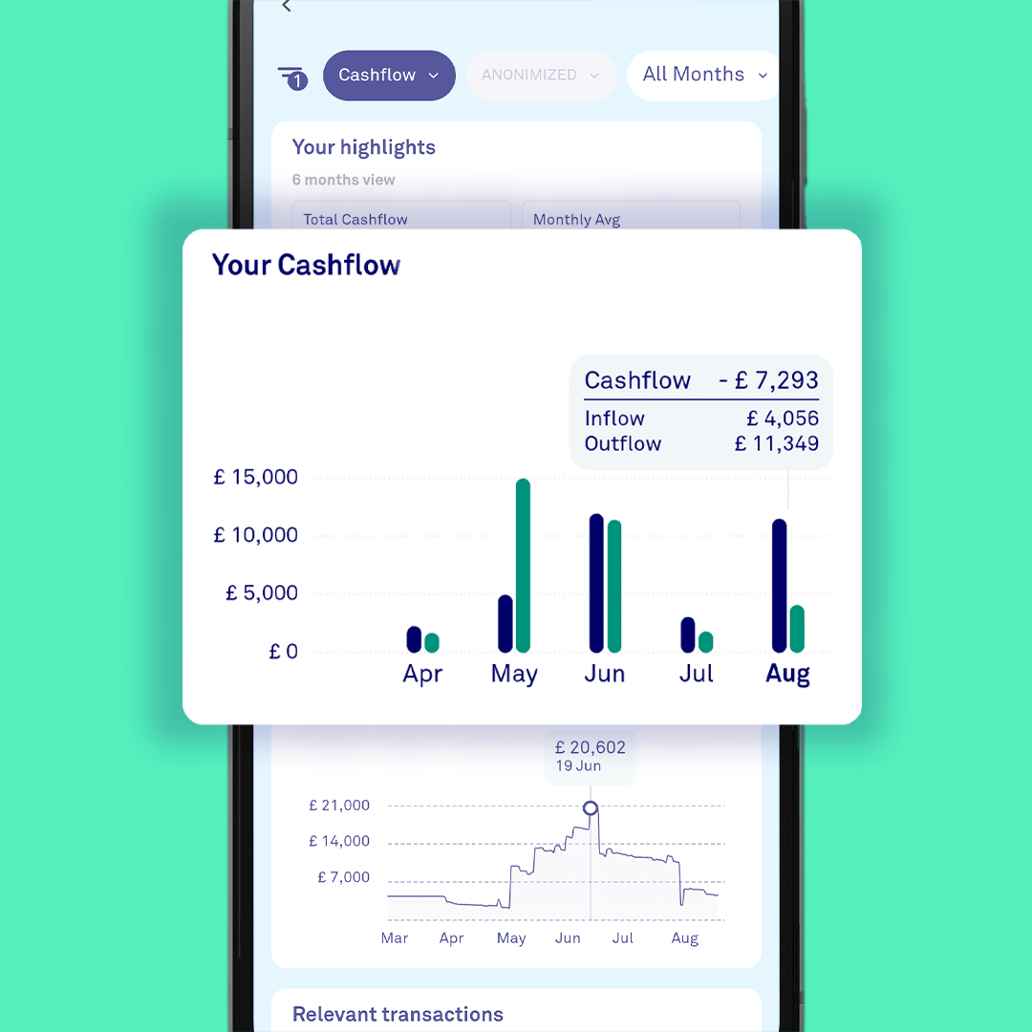

Track your spending – use Insights to track where your money is going. Your spending will be sorted into categories such as “Dining” or “Entertainment,” so you can identify areas where you might be overspending or making choices that don’t align with your saving goals. You might also be able to find examples of where you are spending out of habit or impulse, rather than want or need. It’s also possible to create custom categories so you can really personalise your budget.

Make intentional choices with your money – before making a purchase, take a moment to think about if it aligns with your goals. You might also want to consider the environmental and social impact of your spending by supporting businesses that align with your values.

Insights can also help identify savings opportunities or notify you about increases in regular payments, so you can easily review your usual outgoings and subscriptions. Another good tip is to “pay yourself first”, and set up a standing order to your savings account at the beginning of the month.

How to activate Insights:

If you have a Personal Current Account or Savings Account, you can activate Insights in your Triodos banking app. You will need to update to the latest version of the app to access Insights.

Access Insights by clicking the lightbulb in your app in the top right-hand menu, or click on the notification in your app.

Click through to learn more about the feature using the “Continue” button.

Choose “Yes, activate insights” to opt in.

You’re all set! It may take 24 hours for your Insights to activate.

By switching Insights on, you give permission for this service to use your data. What data we use and how can be found in the frequently asked questions below. You can turn it off again at any time - go to 'More', then 'Preferences & Privacy'. Want to know more about how we handle your data? Take a look at our privacy statement.

Stay alert - protect yourself from fraud

As we introduce new features to improve your banking experience, your security remains our top priority. Remember, fraudsters can attempt to take advantage of changes and in some cases may even impersonate Triodos. If you notice anything unusual or receive suspicious messages - especially those asking for personal or account information or claiming to be from Triodos - please call us via our trusted number which you can find below.

Think something’s not right? Get in touch straight away.

Call us: 0330 355 0355

8am-6pm weekdays (9am-6pm Thursdays). If abroad, call +44 (0)1179 739339.

Thanks for joining the conversation.

We've sent you an email - click on the link to publish your post.