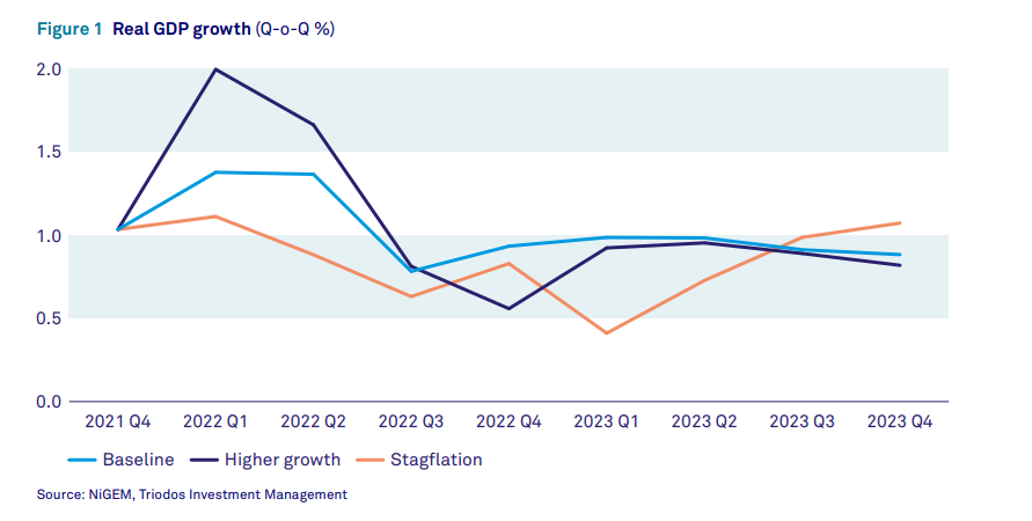

The full report highlights three different scenarios which are all centred around the level of trust that businesses and households will have in policymakers. This level of trust in policymakers to deal with pressing issues such as the pandemic, inflation and climate change will be critical for investments, consumption, and international trade. The three scenarios are:

- A baseline scenario, where the loss in trust will slow and stay above the minimum threshold

- A more pessimistic scenario, where the loss in trust will accelerate (stagflation)

- A more optimistic scenario, where trust levels will improve (higher consumer spending)

Below are eight key points from the latest report to give a flavour of the investment outlook.

1. Recovery continues on shaky foundations

The baseline scenario assumes that the economic recovery should continue into 2022 (see Figure 1), but on shaky foundations. The expectation that the speed of governments’ response to the pandemic, coupled with vaccination progress, would lead to a prolonged period of economic growth with just a moderate uptick in inflation was, we now know, unrealistic.

New, more infectious Covid-19 variants have emerged, and the virus has transformed into an endemic disease. Meanwhile, supply constraints have shown that the lockdowns were more disruptive than initially thought. Together with surging commodity prices, this has pushed inflation far above previous expectations, while simultaneously slowing economic growth. Therefore, trust in policymakers has been deteriorating since summer 2021.

Despite these headwinds, the baseline scenario expects all major advanced economies to experience another year of growth above their long-run averages. It’s predicted that the loss of trust in policymakers will slow because supply constraints (including tight labour markets) in the course of Q1 and inflation will fall sharply in the second half of the year. Very gradual Covid-19 progress due to regular booster shots and possibly new effective drugs will also slow the deterioration of trust. This sets the scene for continued strong consumption due to pent-up household and corporate demand.

2. Household and corporate spending continues to drive economic activity

Household consumption will by far be the most important driver of the expansion in economic activity expected in the baseline scenario. Households in all major advanced economies have been able to substantially increase their savings since the start of the pandemic, and currently households are still saving more of their income than usual. The normalisation of these savings rates and partial spending of the built-up savings will lead to continued consumption growth in 2022.

The second driver of next year’s economic growth is business investments, which will continue to boost economic activity as businesses try to catch up with the elevated demand.

Looking at the current state of the major economies, we know that the US has already reached pre-pandemic levels of activity, as has Japan. However, our baseline scenario indicates that the eurozone will only reach this by Q1 and the UK in Q2 2022.

3. Supply constraints to gradually ease

In the baseline scenario, its expected the Covid-induced supply-side constraints will have largely faded by the end of 2022. The ending of government support schemes should further normalise the elevated unemployment rates and depressed labour force participation rates (both apply especially to the US and the UK), while consumers shifting their spending from goods towards services should alleviate some supply chain pressures.

The stagflation (pessimistic) scenario anticipates ongoing Covid-19 restrictions will disrupt supply chains throughout 2022. A loss of trust in policymakers to get rid of the virus any time soon, and a likely increase in caution to re-enter the labour market, may amplify the supply constraints in this scenario.

In the higher growth scenario, workers will enter the labour market faster than anticipated, as Covid-19 infections are successfully contained and trust in policymakers increases. In this scenario with no Covid-related restrictions, this would ease supply chain disruptions.

4. Inflation will persist, but peak pressures to fade

It’s evident that the sharp rise in inflation in most of the major advanced economies wasn’t purely transitory. Base effects have gradually faded, and inflation is now clearly visible within core inflation. Still, in the baseline scenario, its expected peak inflation pressures will fade as 2022 proceeds, mostly due to base effects and normalising supply chains and labour markets. The US has seen the most substantial rises, then the UK and the eurozone. In contrast, Japan struggles with low inflation rates. Overall, the US and UK bear the highest risk of persistently elevated inflation.

5. The continued disconnect between ‘real’ economy and financial markets

Before the pandemic, Triodos Bank warned the excessive monetary stimulus that has been around since the 2008 global financial crisis’ would lead to a disconnect between the ‘real’ economy and financial markets. But now, with the huge amount of stimulus that has been implemented since the pandemic, this disconnect has further increased. Policies failed to push up real economy inflation, leading instead to artificially high (financial) asset prices. Since then, the balance sheets of the Federal Reserve and European Central Bank have exploded, growing by approximately 100% to reduce the impact of the Covid-induced recession. Policy interest rates of all major central banks have been reduced to close to - or even below - zero. This has numbed financial and housing markets even more and pushed asset prices even further into record territory.

6. Urgent need for transformative action

Besides the level of public trust in central banks, trust in government policies determines the likelihood of the three scenarios. This trust depends largely on government action on three (related) topics: Covid-19, inequality, and climate change. The more optimistic scenario requires governments to convince their citizens they follow the right Covid-strategy. This has already proven to be a daunting task, as the long-term downward trend in institutional trust in advanced economies is accompanied by a waning trust in government measures to tackle the Covid-19 crisis. This is closely related to the Covid-induced increase in inequality.

Failure to contain the virus and its related issues, resulting in prolonged restrictions and a further loss of trust, would reflect the stagflation scenario.

Equally important is the need for governments to translate vague climate pledges into decisive action. This can be a strong signal that substantially increases trust in the green transition as the only way forward. Failure to act could severely impact trust in future wellbeing through growing concerns about the impact of climate change.

7. Bond yields are gradually rising and equity markets to peak mid-2022 at the latest

Eurozone government bond yields are currently still close to historic lows, making the bonds themselves expensive. However, since the start of 2021, we have seen (modestly) rising longer-term bond yields on the back of rising inflation expectations, while real yields have fallen further into negative territory. This has been an indication of the bond market starting to doubt the likelihood of perpetual monetary stimulus. The European Central Bank, on the other hand, still seems committed to keep bond yields low.

Despite this, it’s expected longer-term government bond yields to gradually rise and demand corporates to stay strong, but nevertheless, a modest widening of credit spreads is anticipated. Therefore, our approach remains cautious and neutral in bonds with a preference for high quality names to be included in our investment portfolios. The threat of a sudden de-anchoring of inflation expectations leading to sharply rising interest rates helps to substantiate this scenario.

The US equity market continues to look expensive, both historically and relative to Europe and Japan, with Japan being cheaper than Europe. As economic growth normalises and inflation remains elevated, its anticipated revenue and margin pressures will start building. Therefore, our funds remain underweight inequities.

8. Impact opportunities and the start of stamping out greenwash?

More opportunities continue to be created in the sustainable investment landscape. The European Green Deal (the EU’s roadmap for making its economy sustainable) and the related green taxonomy will enable investors to steer their investments towards more sustainable technologies and businesses, and the creation of an EU Green Bond Standard will deliver a uniform tool to assess green bonds. The Sustainable Financial Disclosure Regulation will also make investors more aware of financial risks related to sustainability, and to some extent limit the options for greenwashing.

Triodos Investment Management compiled these predications in November 2021, and these informed its investment approach. However, this is for information only and isn’t financial advice. Before making any investment, please carry out research and consult a financial advisor if you are unsure about any aspect of that investment and if it’s right for you.

Making a difference

Triodos Impact Investment Funds focus on driving positive environmental and societal change around the world and work hard to deliver competitive financial returns. You can invest in the funds directly or via the tax-efficient Triodos Stocks & Shares ISA.

Please note that with investment in ethical funds and companies, as with all investments, past performance is not a guide for future returns and you may not get back the amount that your originally invested.

The tax benefits of an ISA are subject to change and depend on individual circumstances.

Thanks for joining the conversation.

We've sent you an email - click on the link to publish your post.