Autonomous Investments Properties was founded in 2008 as a subsidiary of Autonomous Investments, with an ethos of creating positive societal change and operating sustainably.

Its founder, Johnny Palmer, is focused on disruption, growth and sustainability, and has even upcycled a Boeing 727 into a meeting place. His other pursuits include cleaning up rivers, Bristol Harbour swimming, developing leading media companies and engineering renewable power innovations.

"Autonomous Investments Properties focuses on creating an environment where people can thrive, ethical businesses can grow and to be a catalyst for sustainable innovation in property," explains Johnny.

In addition to acquiring new commercial properties, the loan from Triodos will be used to refinance an entire street of industrial spaces owned by Autonomous Investments at Bristol’s Skyline Park and enable investment in large scale decarbonisation works at a number of its properties – aiding the move towards Autonomous’s net zero goals.

These units already have eco-spec upgrades but part of the lending from Triodos will be used to upgrade these further. Decarbonisation measures will involve installing insulation, solar power and intelligent building management, aiming to attain a level A3 Energy Performance Certificate rating at these properties.

Johnny is serious about reducing the carbon impact of commercial buildings and hopes this work will demonstrate what is possible within the restraints of original construction and what can be done to improve standard commercial property and its impact on net zero targets. Essentially, driving the sustainability agenda whilst still being commercially viable.

“The funding from Triodos will help us to demonstrate what can be done practically to improve standard commercial property and its impact on the net zero agenda," adds Johnny.

“For example, at Skyline Park we’ve already built Bristol’s largest off-grid power station and completely removed the gas supply from the largest facility there by investing in renewables including solar and air source heat pumps.”

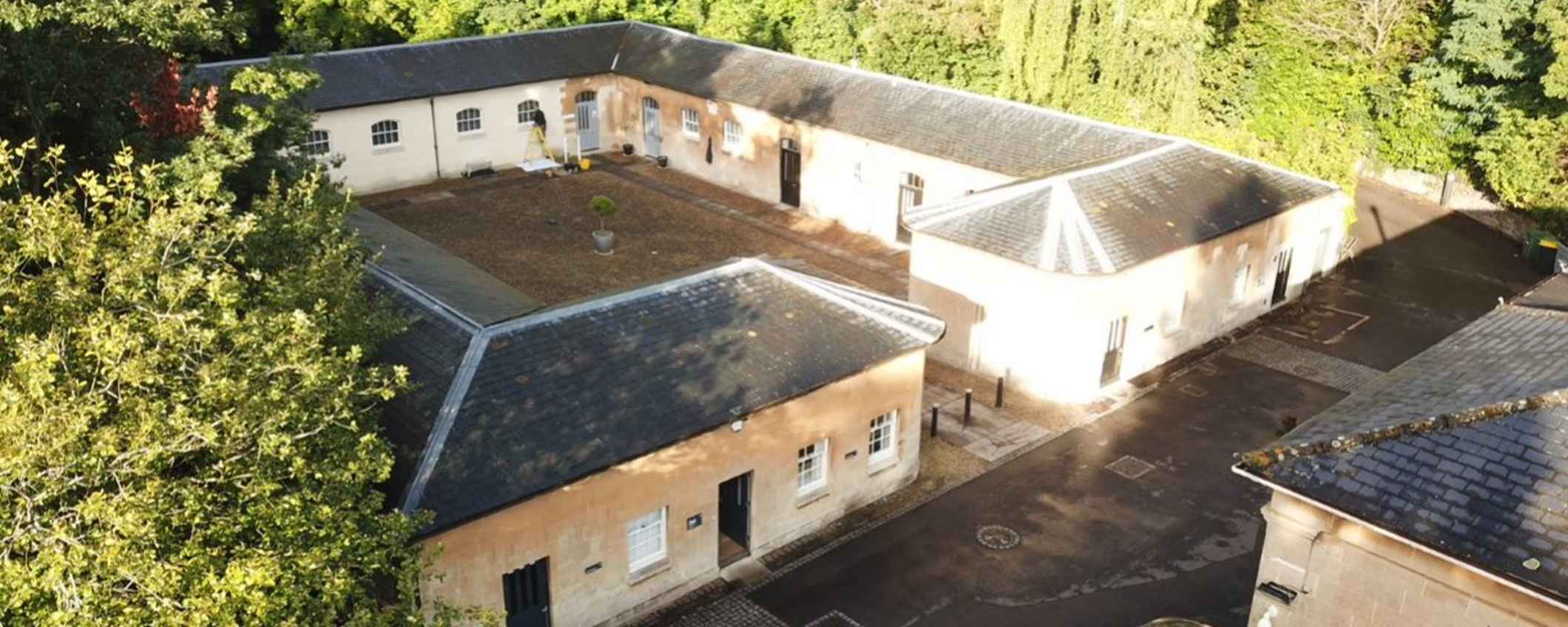

The financing has also enabled the purchase of the Stable Block at Bristol’s Leigh Court – a Grade II listed building where decarbonisation and modernisation work will be carried out in a way that ensures the building’s heritage is maintained and celebrated.

Speaking about the lending, Phillip Bate, Business Banking Team Leader at Triodos Bank, adds: “We’re proud to support a company that’s doing such great work to improve energy efficiency and tackle decarbonisation in the commercial property sector. By showing what’s possible to achieve within the constraints of a building’s original construction, while remaining commercially viable, we hope Autonomous Property Investments will provide a strong example for others to follow."

Thanks for joining the conversation.

We've sent you an email - click on the link to publish your post.