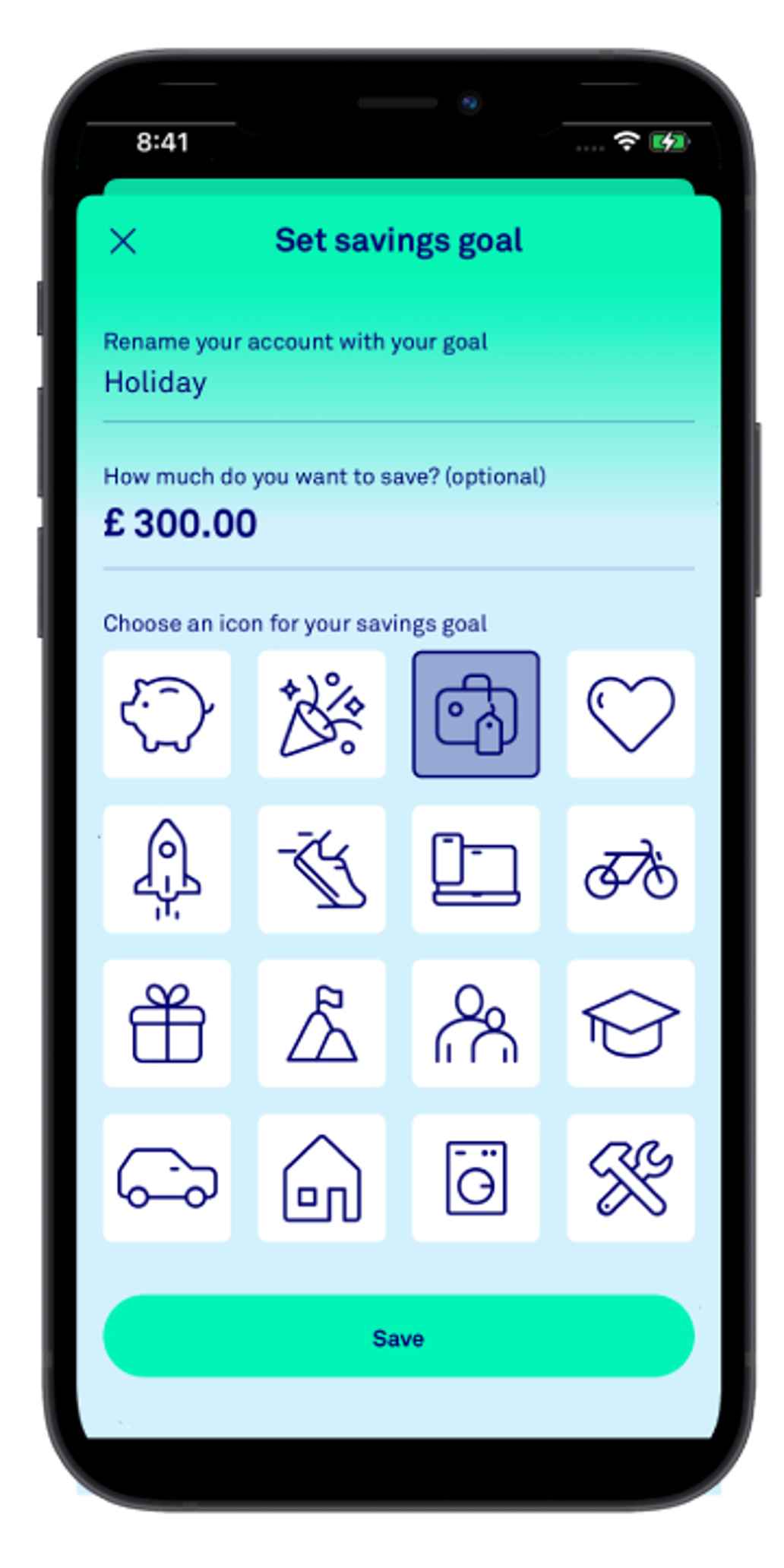

Name your savings account

Motivate yourself to meet your savings goals and better manage your savings by naming your savings accounts. In the app you can rename your savings account so that you know exactly what you’re saving for. For example "Emergency Fund", "Travel", or "House Deposit".

You can also easily open new savings accounts to save for multiple goals by tapping "More" in the app.

Set your savings goals

When you name your savings accounts, you can also set a savings goal. You have a handy progress bar to track your savings in the overview page in the app.

Please note that standard deposit restrictions and ISA allowances apply when setting savings goals for your accounts. If you have already contributed the maximum deposit applied to your account, you will need to open an additional savings account to save towards your goals.

Make the most of tax-free savings

Your Personal Savings Allowance depends on how much of the interest earned on your savings is taxable. Basic rate (20%) taxpayers can earn up to £1,000. Higher-rate (40%) taxpayers can earn up to £500 before tax, and additional-rate taxpayers don’t get a Personal Savings Allowance. Check for the most up to date information here.

If you save your money in an ISA, all the interest you earn is tax free, regardless of your Personal Savings Allowance status. You can currently put up to £20,000 per tax year into your ISA. You can also spread this allowance between different ISA accounts, for example, if you wanted to put some in a Cash ISA and some in a Stocks & Shares ISA.

Easy access or fixed?

It’s a good idea to have some of your savings instantly accessible, in case of emergencies or expenses coming up in the short-term, and then also make the most of higher interest rates with a fixed account. This locks away your savings for a set amount of time and is better suited to longer-term expenses. So, you could, for instance, open a 1 year fixed savings account in advance of a holiday or family birthday. With a Triodos fixed account, no further deposits are allowed after the full opening deposit is received.

Your money is making a difference

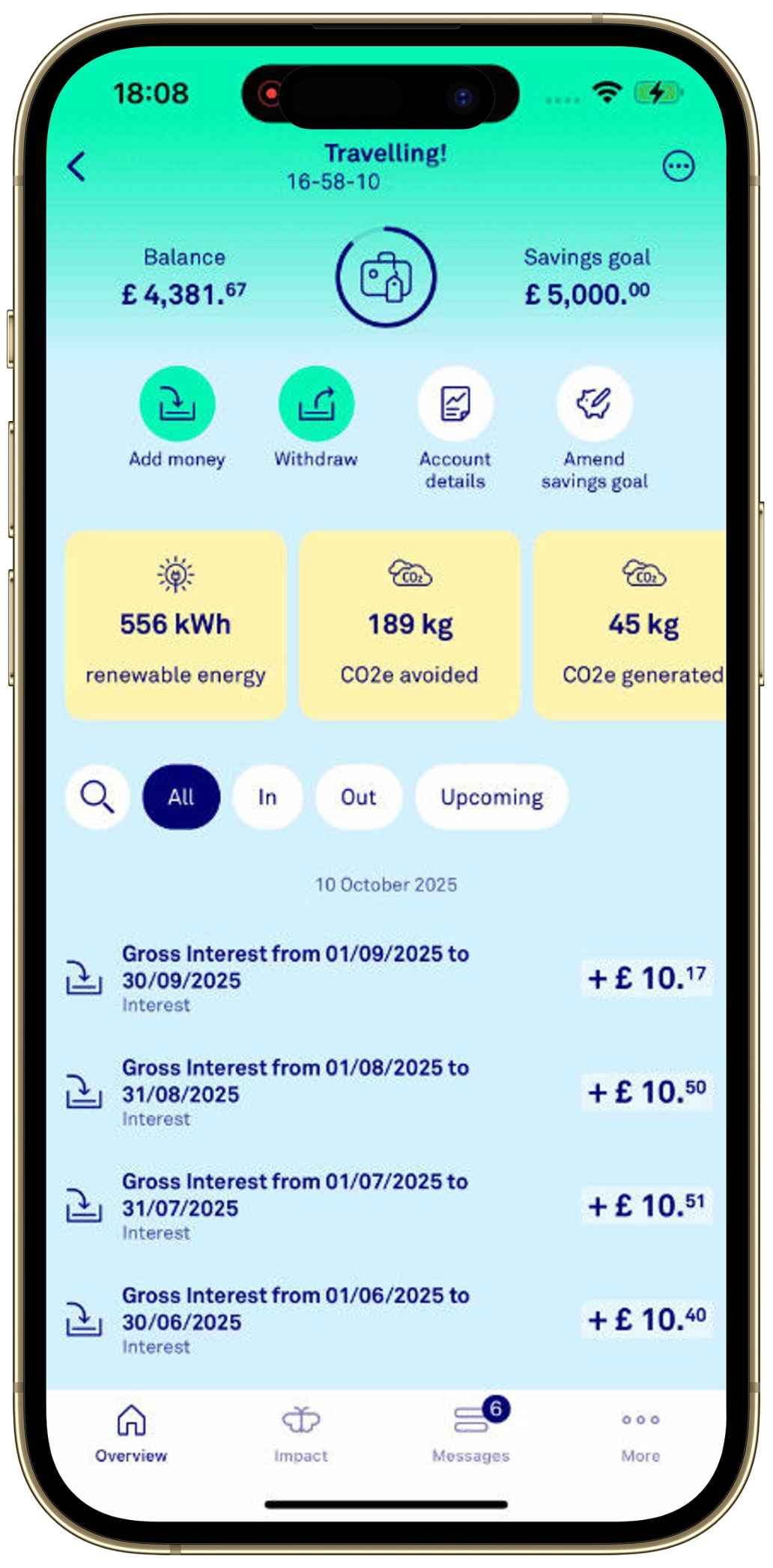

While you’re saving and earning interest with Triodos, your money will finance projects that make a positive and lasting impact on society and the environment. We pride ourselves on being transparent about how your money is being used, so we are the only UK bank that publishes the details of every single loan we make and the positive impact that it’s having. You can find inspiring stories about the projects we finance under “Impact” in the app.

You can also track your impact in your mobile banking app, where your savings balance is converted into renewable energy generated, CO2 emissions avoided, organic meals, and more!

Thanks for joining the conversation.

We've sent you an email - click on the link to publish your post.