If you’re self-employed or rent out property, you will be affected by significant changes in tax reporting called ‘Making Tax Digital’ which will fundamentally change the way people file tax information from April 2024. Personal tax service untied explains more.

What is Making Tax Digital?

Making Tax Digital is the umbrella term for a wide programme of changes in reporting across different taxes.

Income Tax is next in line. From April 2024, new quarterly reporting requirements will be extended to millions of personal taxpayers and small business owners. This includes sole traders, those in partnerships and property landlords (including short term rentals such as through Airbnb) with annual income over £10,000.

This part of the programme is called Making Tax Digital for Income Tax Self Assessment, or MTD ITSA for short.

What is changing for Making Tax Digital for Income Tax Self Assessment (MTD ITSA)?

The key requirements will be to:

- use third party software

- keep digital records

- report quarterly in-year

- submit a final return to HMRC by 31 January after the end of the tax year

What do I need for MTD ITSA?

From April 2024, you’ll not be able to file your MTD returns directly with HMRC. Instead you'll want to choose the right approved and compatible software that suits you. It will be a big change for many people.

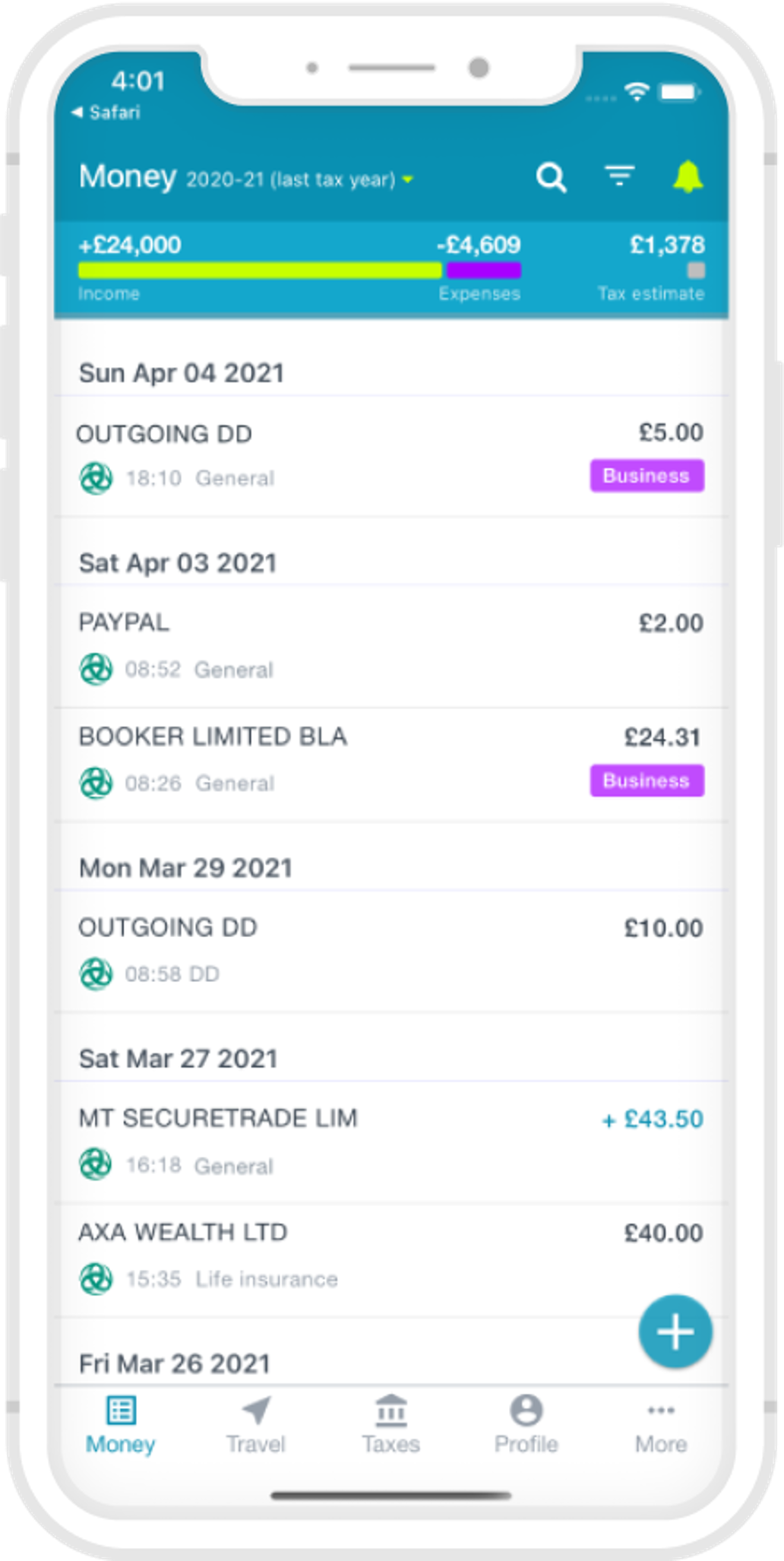

untied is the first end to end app recognised by HMRC for Making Tax Digital for Income Tax. untied can also help you migrate from paper records, spreadsheets or other existing software.

Triodos has arranged for our customers to enjoy a discount when you sign up for untied. This will save you £3 a month off an annual subscription to untied – reducing it to just £63.99.

When do I need to starting thinking about MTD ITSA?

As a taxpayer, you have until January 2024 to implement these changes, but you’ll probably want to start now and get ahead, saving you time and money.

Is MTD ITSA something I definitely need to do?

If you have an annual business income of over £10,000 then Making Tax Digital will be compulsory—you will need to start using MTD ITSA recognised software by April 2024. It won' t be something you can ignore, as although HMRC may be understanding, it’s likely that a new penalty regime will be introduced too.

Is anyone exempt from MTD ITSA?

HMRC has confirmed an exemption from Making Tax Digital for unincorporated businesses and landlords with a gross income/annual turnover below £10,000.

How can I get involved in MTD ITSA?

Triodos customers can already file their self assessment tax returns using the untied app, and have an opportunity to take advantage of their early adopter programme for MTD. You will get close support from untied and HMRC on your MTD journey, a chance to understand the changes that Making Tax Digital brings, and to provide feedback to untied and HMRC on the experience.

You'll also benefit from existing untied functionality including streamlined tagging and tax optimisation, and be well ahead for when the new rules come into force!

How to access your Triodos customer discount with untied

Triodos has linked up with untied, the UK’s personal tax app, to help with the transition to Make Tax Digital. untied links to your Triodos and other accounts, brings in other data from HMRC, makes tax sense of your transactions, and helps you file to HMRC straight from their mobile app or in your web browser. untied also offer online webinars, and bring five star support. All for just £64.99 a year if you’re a Triodos customer.

To get started and take advantage of the special offer for Triodos customers, visit www.untied.io/triodos today.

Thanks for joining the conversation.

We've sent you an email - click on the link to publish your post.