Adding to a growing list of organisations looking to uncover the truth behind these claims, well-established consumer champion organisation Which? has recently teamed up with Ethical Consumer to rate the sustainability of banks and building societies that provide savings accounts in the UK.

Ethical Consumer has been helping to identify conscious choices for over 30 years, having its roots in boycotts and campaigns that aimed to affect companies involved in the South African apartheid regime. Which? has more than 60 years’ experience in promoting informed consumer choice and offering independent advice, but has only included environmental issues in more recently.

“It is a challenge for genuinely sustainable alternatives to grow when price comparison websites and consumer magazines are only comparing banks on interest rates and terms,” says Bevis Watts, CEO of Triodos Bank UK.

“There is also consumer value in comparisons based on sustainability or ethical criteria, which is why it’s great to see Which? coming out with these new ratings. After all, the value of an interest rate or cash bonus may well mask that it is being paid for by financing deforestation, fossil fuels, arms or tobacco – all of which undermine a fair and sustainable future for that account holder.”

The most sustainable providers of savings accounts

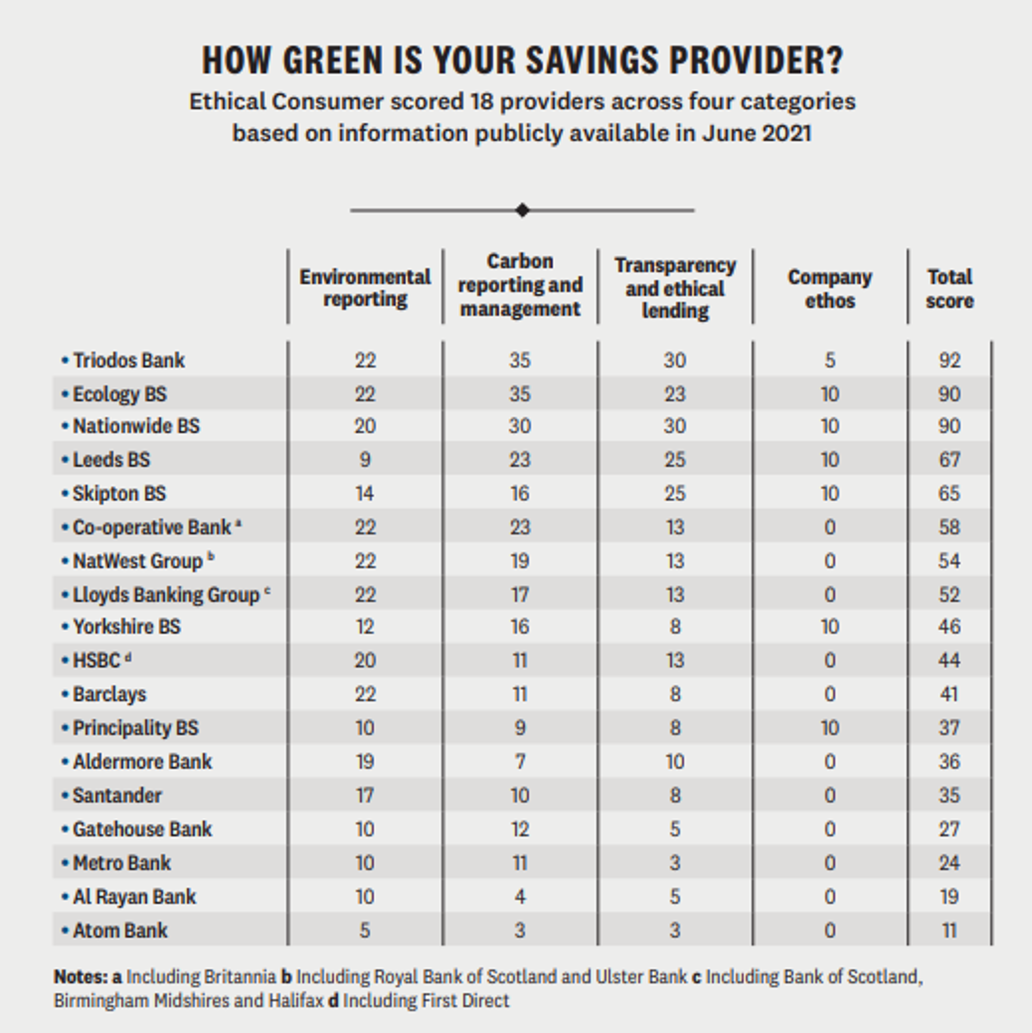

The recent research from Which? and Ethical Consumer gave each financial provider a ranking out of 100, based on publicly available information about how they use savers’ deposits, the environmental impact of the industries they fund, and what the bank or building society was doing to reduce this.

Triodos Bank scored 92 out of 100, placing it top of the rankings overall. In particular, the bank scored the maximum available for ‘carbon reporting and management’ as well as ‘transparency and ethical lending’. As the only bank that publishes all of its lending online, as well as one of the pioneering forces behind measuring the carbon impacts of investments and loans, it isn’t too surprising to see high scores in these areas.

“We’re pleased to be recognised for our unique approach to sustainability and transparency in finance through this new ranking,” Bevis adds. “Sustainability is absolutely at the heart of Triodos Bank and we’re pleased to enable people’s money to be used as a force for good through our savings accounts, as well as current accounts and investments.”

By comparison, the lowest overall score was 11 out of 100. Building societies and specialist banks tended to score higher than any high street providers.

The full article, which details the methodology and full scores is available on the Which? website. You can also listen to The Which? Money Podcast episode, featuring an interview with Bevis, on Acast.

What does this mean for the future?

It’s clear that the general public, financial institutions and consumer organisations are all now conscious that it’s not simply interest rates and customer service that can sway customers – there’s also a number of values-based issues to take into account.

We certainly expect to see more of these kinds of rankings and guides in the future and welcome the impact they will have on the whole banking sector.

Ranking banking

If you’d like to see further analysis of how UK banks are performing on sustainability, we recommend checking out Switch It or bank.green. Good with Money and Ethical Consumer also have plenty of advice.

Thanks for joining the conversation.

We've sent you an email - click on the link to publish your post.