The solution might be to put away a small amount regularly. Saving little and often – for example monthly – means that you feel less impact on your day-to-day finances. Over time, however, these modest monthly amounts might become a useful sum that could provide some financial resilience or boost savings for your retirement. What’s more, if you choose to save or invest with a sustainable provider, then you’ll also know that your money is being used to help tackle some of the biggest challenges facing society.

For most people, the first option to consider will be cash savings. However, once you have around three to six months’ worth of income saved, many experts suggest looking at investing in the stock market. This offers the potential for higher returns over a long period of time, but also comes with risk. This means that you might lose the money you invest, or get back less than you put in.

Little and often could be the best approach

Recently, economic uncertainty has made stock markets volatile. This means that the value of investments is likely to change rapidly within a short period of time. However, when investing monthly, stock market volatility can work in your favour – as in the example below.

Suppose you start investing £100 per month at the beginning of the year, in an investment fund with a price of £1 per unit. Over a few months the price falls to £0.90, before recovering to £1 by the end of the year. If you had simply invested a £1,200 (£100 x 12) lump sum at the start of the year, your investment would still be worth £1,200 at year end.

However, if you had invested £100 per month instead, your investment would be worth more than £1,200 by the end of the year. The graph below illustrates how this could happen.

Note that this is simply an example, and you should never rely on the past performance of an investment as an indication of how its value might change in the future.

This example shows the benefits of ‘pound cost averaging’ – whereby investing regularly means you average out the price at which you invest, reducing the risk of investing at the wrong time.

Of course, when markets are rising (so the price of an investment is increasing) then you would be better off investing a lump sum. Nevertheless, you would still see the total value of your money go up if you chose to invest monthly. Please note this article isn’t personal advice, and everyone’s circumstances will be different. If you are unsure whether investing is right for you, then please speak to a financial adviser.

Investing with impact

Triodos Bank offers three award-winning investment funds in the UK, all of which have the potential for long-term growth, while delivering positive impact for people and the planet. The funds invest in organisations that are supporting the transition to a more sustainable society.

Triods Investment Management (Triodos IM), the investment arm of Triodos Bank, has been pioneering impact investments for 30 years. In addition to avoiding investments in industries such as fossil fuels and arms, Triodos IM uses its position and expertise to actively engage with the organisations it funds to help them drive positive change.

Find out about our range of funds

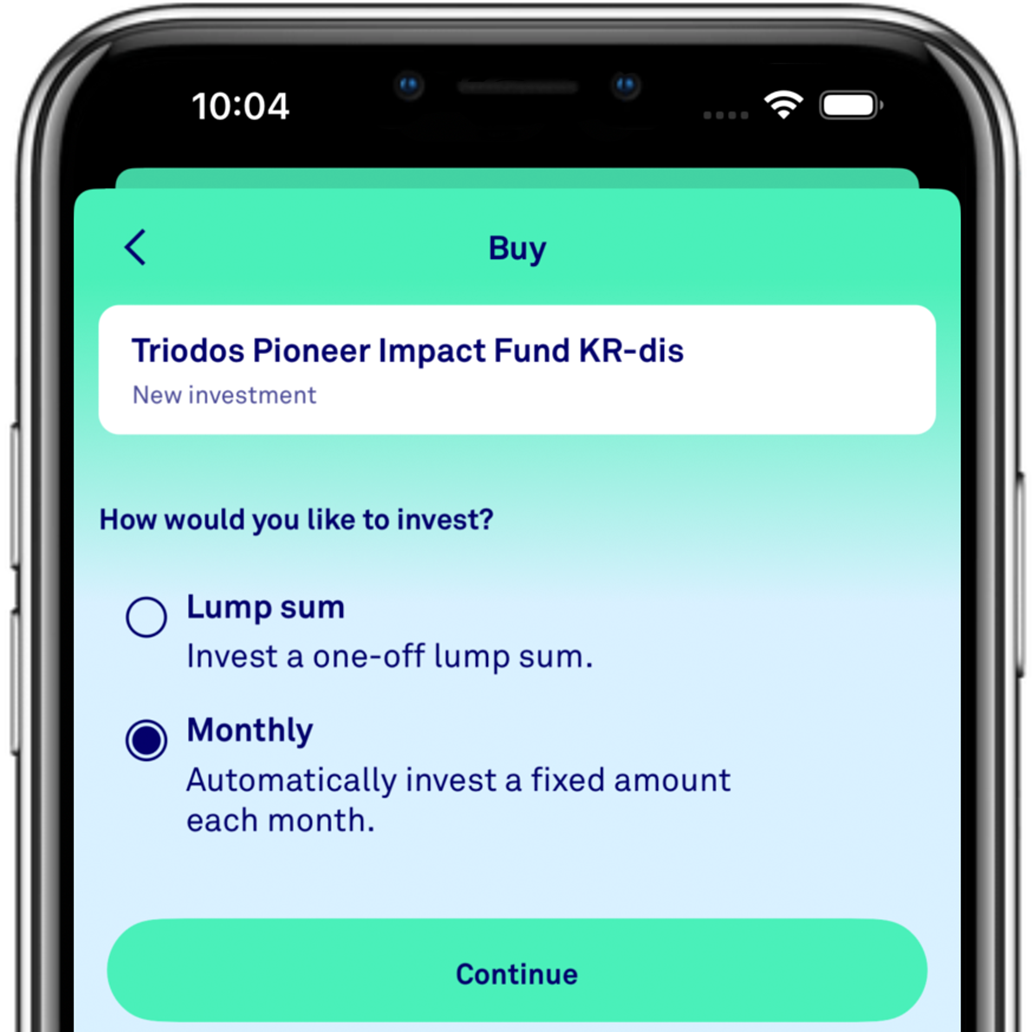

With the new monthly investment option, you can start investing in the Triodos impact investment funds from as little as £25 per month.

Whilst making small monthly investments can reduce the negative impact of market volatility, as we’ve explained above, please remember that all investing comes with risk. You could get back less than you originally invest.

Investing comes with risk

As we’ve highlighted in this article, investing is not the same as putting your money into a savings account – your money is at risk. Investments should be regarded for the long term (at least 5 years) as they can go down as well as up in value, and so you may not get back the amount you originally invested. You should never invest more than you can afford to lose.

The value of tax savings, if you choose to invest via a Stocks and Shares ISA, will depend on your personal circumstances and tax rules can change over time. ISA rules also apply.

Investments are not covered by the Financial Services Compensation Scheme

Thanks for joining the conversation.

We've sent you an email - click on the link to publish your post.