- Seven in 10 UK consumers say banks and financial providers need to be more transparent about how they invest their customers’ money, while half think financial providers actively hide the sectors they invest in.

- 2.6 million young people plan to open an ISA this year with lockdown savings, as four in 10 say their interest in investing has increased.

- Younger investors could fuel a rise in impact investments as 94% say they have or would switch their ISAs to an ethical provider.

UK ISA holders are calling for increased transparency in how their money is invested, amid a rise in interest in ethical and sustainable investments spurred on by the pandemic and a new generation of investors.

New research from Triodos Bank UK can reveal that seven in 10 UK consumers (71%) think that banks and financial providers need to be more transparent about how they invest their customers’ money, while two thirds (64%) say the Government needs to do more to make banks be transparent.

Meanwhile, half of UK adults (50%) think that banks and financial providers purposefully hide the sectors they invest in from their customers.

Consumers are also calling for increased transparency when it comes to avoiding greenwashing, with 64% saying there needs to be industry-wide standardisation in the definition of ‘sustainable’ or ‘ethical’ funds.

Yet despite this strong call for transparency, the majority of ISA holders (61%) admit that they have never taken steps to ensure their money is being invested in line with their values.

Young consumers look to invest pandemic savings

2021 could be the year that sustainable investing sees a boost in the UK, with a new generation of younger investors looking to use their money in a way that creates positive social and environmental change, as well as providing long-term financial security.

While many younger people have faced unemployment, reduced working hours or a difficult financial situation over the past year, two fifths (42%) have found themselves with more money to spare from not spending as much during the pandemic.

For young people on both sides of this coin, investments are becoming increasingly attractive. Four in ten 18-34 year olds (40%) say that their interest in ISAs and investing has increased during last 12 months, with the most common reason for this being that the pandemic has made them more aware of the need to have a secure long-term financial future.

One in five 18-34 year olds (18%) – equating to over 2,600,000 people* – are looking to open a new or additional ISA this year, while an additional one in 10 (9%) will move more money into an existing ISA. These new investments are most commonly going into investment, rather than cash ISAs – with 51% planning to open a Stocks and Shares ISA, and 25% considering an Innovative Finance ISA that offers crowdfunded investments.

Younger investors are much more likely to choose investments and providers that align with their values, with 94% of ISA holders age 18-34 saying they already have, or would consider switching their money to an ethical provider – compared to 71% of over 35s. This indicates that as the next generation of investors comes to choose their ISA products, there could be a significant boost in ethical and sustainable investments.

Increase in values-based investing

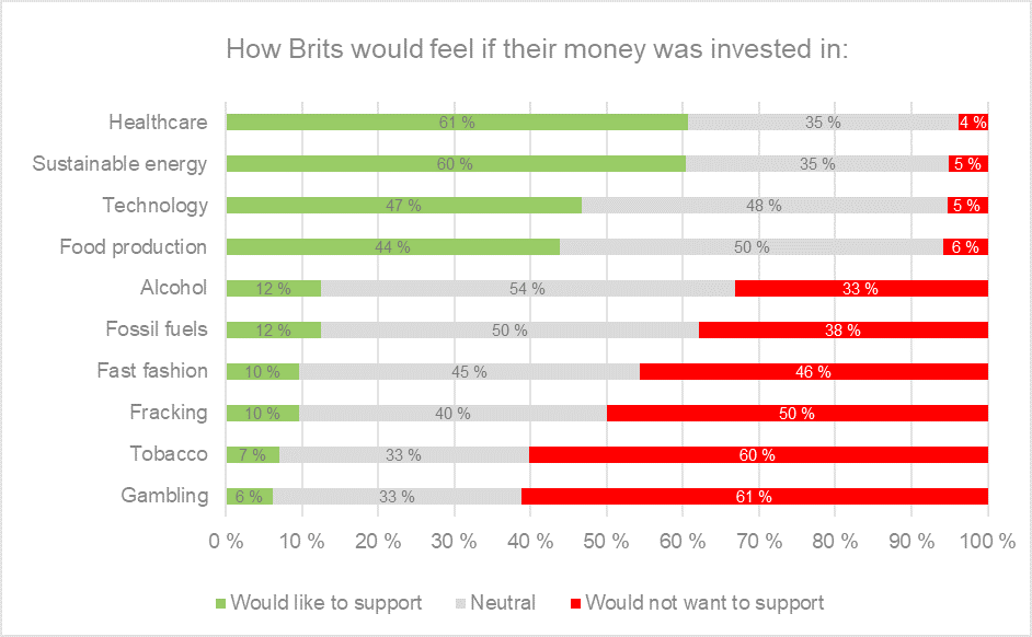

Across all ages, interest in ethical investments are on the rise. Investors are looking to use their investing power to support healthcare and a greener future, with two thirds (62%) claiming the industry needs to do more to help people invest their money in a way that supports positive social and environmental change.

When it comes to avoiding industries with negative connotations, there is a clear opportunity to offer investors the chance to align their money with how they choose to act on their personal values in other ways. Over a third of people who wouldn’t want their investments to support fossil fuels (37%), fracking (36%) or gambling (33%) say they would not work in these industries. Likewise, a third of those that wouldn’t want to invest in fossil fuels (37%), fracking (34%) or fast fashion (32%) say they would not vote for a politician that had links to these sectors.

Gareth Griffiths, head of retail banking at Triodos Bank UK, said: “When such a large proportion of young people are interested in an impact investment ISA that matches their values, it suggests that there has been a real step change in awareness of the links between personal finances and the wider world. We want to encourage people to think about what their ISA pot is doing, just as they would consider the ethics of what company to work for or what politician to vote for.

“As a new generation looks to ISAs for post-pandemic financial security, demand for funds to be transparent in their investments will only increase. For too long, the financial industry has hindered consumers from being able to make informed choices about where their money goes. We need to give consumers clear options to use their investments in line with their values – whether that’s investing in new technology, sustainable energy or healthcare systems.”

Kia Commodore, personal finance expert and founder of financial literacy platform Pennies to Pounds, said:“Young people are sparking a movement towards sustainable investments that will make ripples throughout the investment industry. We are seeing the rise of empowered investors, who want to know much more about where their money is going and what it is funding. They are taking control and making decisions to invest in companies that best align with their personal values. Investment providers who fail to join this movement may lose the backing of this new generation of investors in the long term.”

Triodos Bank offers award-winning Impact Investment funds available through a Stocks & Shares ISA in the UK – the Triodos Pioneer Impact Fund, the Triodos Global Equities Impact Fund and the Triodos Sterling Bond Impact Fund. Long term performance of the funds shows a five-year average return of 10.75% for the Triodos Global Equities Impact Fund and 13.34% return with the Triodos Pioneer Impact Fund**. Note that past performance is not a guide to future returns.

Triodos Bank also offers an Innovative Finance ISA (IFISA) through its crowdfunding platform, which offers direct investments in bonds with organisations delivering positive change.

Important information

Capital in any investment product is at risk. The value of an investment may go down as well as up and investors could lose some or all of their money. Currency fluctuations may also affect the value of a Triodos Stocks & Shares ISA. For the Triodos Innovative Finance ISA, investors may not be able to access their capital during the life of their investment. As with all ISAs, the tax benefits depend on individual circumstances, and tax rules may change. The total annual ISA allowance is £20,000, which can be split across different types of ISAs.

-Ends-

None of the information in this press release constitutes financial advice. If potential investors are unsure if these investments are right for them, they should contact an Independent Financial Adviser.

Media contacts

For interview requests, case studies and photography, please contact Julia Bush, Greenhouse PR at [email protected].

About the research

Research was conducted by Opinium Research on behalf of Triodos Bank. The sample polled 2,007 UK adults, weighted to be nationally representative. Questions to existing ISA holders were boosted to 500 respondents with a Stocks and Shares or Innovative Finance ISA. Polling took place between 16-19 February 2021.

* Calculated based on ONS population figures (released June 2020) showing 52,673,433 people aged 18-90+, and 14,659,036 people aged 18-34 in the UK.

About Triodos Impact Investment Funds

- The Triodos Global Equities Impact Fund aims to generate positive impact and competitive returns from a concentrated portfolio of equities issued by large-cap companies offering sustainable solutions. It has generated an average return of 10.75% over the last 5 years**.

- The Triodos Pioneer Impact Fund aims to generate positive impact and competitive financial returns from a concentrated portfolio of small- and mid-cap companies pioneering the transition to a sustainable society. It has generated an average return of 13.34% over the last 5 years**.

- The Triodos Sterling Bond Impact Fund aims to generate positive impact and stable income from a concentrated portfolio of investment-grade, GBP denominated bonds issued by listed companies, semi-public institutions and UK gilts.

** As of 28 February 2021. Note that past performance is not a guide to future returns.

About the Triodos crowdfunding platform

Triodos Bank connects investors directly with positive organisations seeking finance through its crowdfunding platform. Investors can choose to invest in bond or share offers by businesses, charities and social enterprises working to deliver positive change. The Innovative Finance ISA (IFISA) allows investors to receive the interest they earn on eligible crowdfunded investments tax-free.

About Triodos Investment Management

Triodos Investment Management connects a broad range of investors who want to make their money work for lasting, positive change with innovative entrepreneurs and sustainable businesses doing just that. In doing so, it serves as a catalyst in sectors that are key in the transition to a world that is fairer, more sustainable and humane.

Triodos IM has built up in-depth knowledge throughout its 25 years of impact investing in sectors such as Energy & Climate, Inclusive Finance and Sustainable Food & Agriculture. It also invests in listed companies that materially contribute to the transition toward a sustainable society. Assets under management as per end of June 2020: EUR 4.9 billion.

Triodos Investment Management is a globally active impact investor and a wholly owned subsidiary of Triodos Bank NV.

About Triodos Bank

Founded in 1980, Triodos Bank has become a frontrunner in sustainable banking globally. As an independent bank that promotes responsible and transparent banking, it does not see any conflict between a focus on people and the planet and a good financial return. Instead it believes that they reinforce each other in the long-term.

Triodos Bank has banking activities in the Netherlands, Belgium, the UK, Spain, and Germany as well as Investment Management activities based in the Netherlands but active globally. Triodos Bank co-founded the Global Alliance for Banking on Values (GABV), a network of 63 sustainable banks. Together these banks want to grow sustainable banking and its impact on the real economy substantially.

- triodos.co.uk

- knowwhereyourmoneygoes.co.uk

- twitter.com/triodosuk

- facebook.com/triodosbankuk

- triodoscrowdfunding.co.uk

Triodos Bank UK Ltd is a wholly owned subsidiary of Triodos Bank NV. Registered Office: Deanery Road, Bristol, BS1 5AS. Registered in England and Wales Company No. 11379025. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration number 817008. VAT reg no 793493383.